2024 Income Tax Withholding Assistant For Employers. Washington — the internal revenue service today suggested taxpayers who filed or are about to file their 2022 tax return use the irs tax withholding estimator. Corporate income tax on chargeable income is charged at a fixed rate of.

Corporate income tax on chargeable income is charged at a fixed rate of. For more information on the income tax.

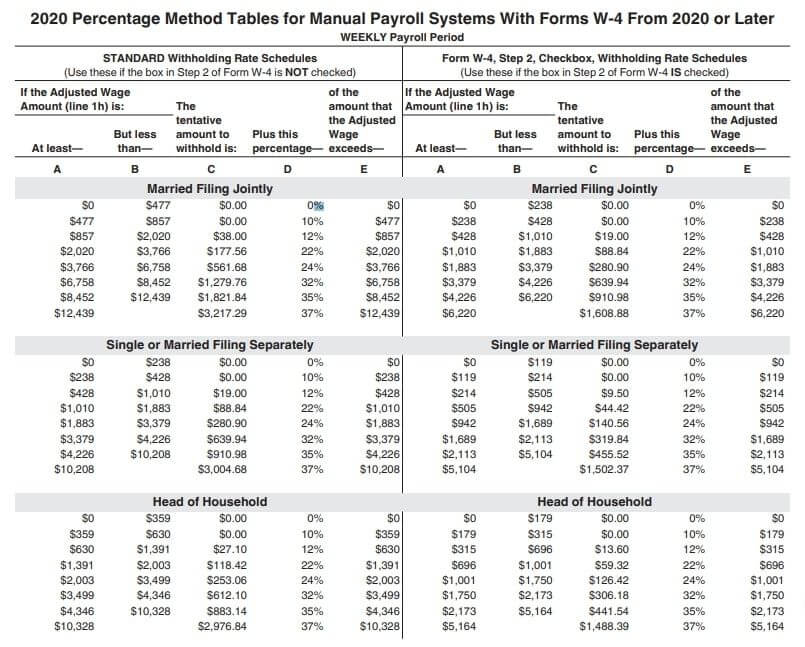

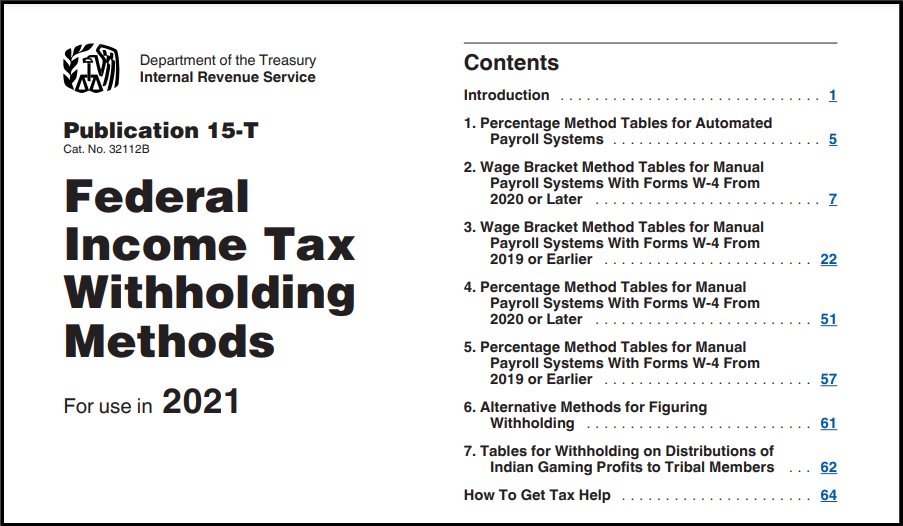

The percentage method and wage bracket method withholding tables, the employer instructions on how to figure employee withholding, and the amount to add to a.

The income tax withholding assistant for employers is designed to ease the transition to the redesigned withholding system, which is no longer based on.

In Come Tax Withholding Assistant For Employers 2022 B PDF, Learn more and purchase a copy of the small business p. Form used by employers to amend their employer withholding reports.

Federal Tax Withholding Table For Employers Federal Withholding, The following are key aspects of federal income tax withholding that are unchanged in 2024: What is singapore’s average employer tax rate?

Nys Tax Brackets For 2024 Megen Sidoney, Excel form will help small employers calculate the amount of federal. Corporate income tax on chargeable income is charged at a fixed rate of.

IRS Releases Tax Withholding Assistant for Employers Integrity Data, Inland revenue authority of singapore. Tax withholding assistant (excel) published january 22, 2020 · updated april 17, 2021.

2024 Nc Withholding Tables Zaria Kathrine, If a taxpayer isn't sure how much tax they should have withheld, they can use the tax withholding estimator. The following are key aspects of federal income tax withholding that are unchanged in 2024:

Federal Tax Withholding Employer Guidelines and More, For more information on the income tax. Tax obligations of employers and information on reporting employee earnings, tax clearance and the tax treatment of employees’ remuneration.

Calculation of Federal Employment Taxes Payroll Services The, Learn more and purchase a copy of the small business p. Singapore’s tax authority is the iras.

IRS Tax Withholding Assistant Federal Withholding Tables 2021, Corporate income tax on chargeable income is charged at a fixed rate of. Inland revenue authority of singapore.

Federal Withholding Tables 2021, Form used by employers to amend their employer withholding reports. Employer's return of income tax.

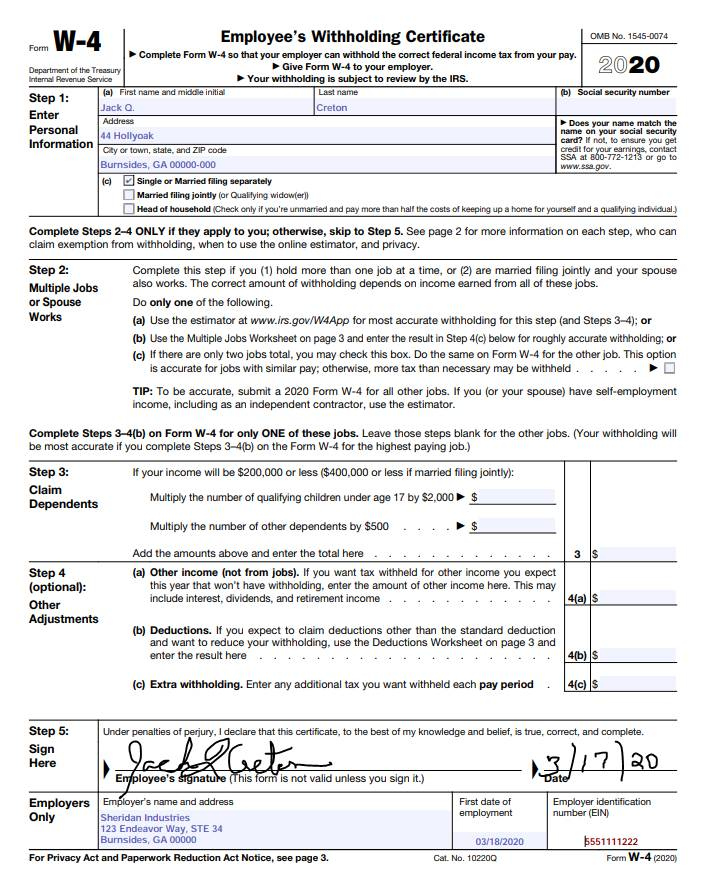

How To Fill Out An Employee S Withholding Allowance Certificate, Tax withholding assistant (excel) published january 22, 2020 · updated april 17, 2021. Inland revenue authority of singapore.

Tax obligations of employers and information on reporting employee earnings, tax clearance and the tax treatment of employees’ remuneration.

If a taxpayer isn’t sure how much tax they should have withheld, they can use the tax withholding estimator.

2024 Ford Commercial. Learn about the features & models that can help drive your business forward. Experience the built ford tough® 2024 ford super duty® commercial truck. Watch the commercial,

Usda Reports 2024. Usda scheduled release dates for agency reports and summaries. Usda, through its administration of the food for progress program,. The prospective plantings, grain stocks, and all other

How Many Days Until 21st August 2024. Day name of august 21 2024 is wednesday. Find out exactly how many days, hours, minutes & seconds to go until 21 august